- ClimateHub

- Posts

- How startups are disrupting century old utility business

How startups are disrupting century old utility business

Top 10 best solutions across the grid's lifecycle

TL;DR

For the most of past 140 years, the electrical grid was being developed slowly but steadily. Although it's a well-functioning engineering artwork, there are challenges ahead

Energy transition fundamentally shifts the operating model according to which the grid was designed. Electric vehicles, solar panels, smart thermostats, heat pumps, batteries, and data centers were not envisioned a century ago.

This poses a great opportunity for climate tech innovation. We see a number of solutions disrupting every stage of the grid life cycle - from planning, through operations and the ability to handle new market design and new business models.

About 140 years ago, in October 1879, Thomas Edison invented the light bulb, bringing electricity to the masses. Initially, the light bulbs were powered by a nearby coal-fired power plant through a DC current. In the subsequent years, Edison’s employee and business rival Nikola Tesla pioneered AC-current technology which set the fundament for the long-distance transmission of electricity.

Today we can proudly say that the electrical power grid is the most advanced engineering achievement of the XXth century. Millions of miles of power lines across the world connect remote power plants with people to provide steady and stable delivery of power. Although we still have places on Earth without access to power, global electrification did great strides in the last hundred years.

The biggest challenges, however, are yet to come. For the most of past 140 years, the electrical grid was being developed slowly but steadily. Large-scale power plants were built and along them set of power lines to bring electricity to consumers. In the last years, we see a dramatic shift to the incumbent operating mode. There is a simultaneous surge of both new electric appliances plugs into the grid as well as new sources of renewable-powered electricity generation. In the US alone, 87% of new utility-scale generation capacity in 2021 came from renewables. And that poses a grand challenge.

How do you ensure that these millions of new electric vehicles, solar panels, thermostats, heat pumps, batteries, data centers, and other new devices are seamlessly working together, perfectly synchronized, and interoperable? Both as a source and flexible demand for electrical energy. How do you adjust the market? Consumers like you and me, are no any more passive users of the system. We demand greater flexibility as well as new business models - making money on our Tesla and solar panel

The ecosystem of the electric power grid is being drastically affected. Virtually every element of the grid’s lifecycle, we see new actors, new ways of working, and a tremendous amount of innovation.

In this article, we want to walk you step by step through what is happening.

Planning & Design

The electricity network is built up mainly of overhead lines, underground cables, and substations, all of which have to carry electricity from one place to another. As the electricity flows through the network, all these pieces of equipment heat up. The more power that flows, the hotter they get. Since overheating can be damaging, all of the devices are given a maximum power rating they can handle.

Luckily, the network is designed with a certain peak load in mind. The problem is, however, that it was done decades if not a century ago. Meanwhile, we added and are adding all of these new technologies - electric vehicles, smart devices as well as renewable power plants that cause an increase in power flow. And it’s not just about monitoring the load. The devices connected to the network can accept electricity at a certain quality - within a certain frequency, magnitude, and waveform of voltage and current. Adhering to the is critical for the safe operation of the power grid as well as the satisfaction of consumers.

Therefore, the major concern of grid operators and regulators is to ensure all of the energy transition devices will smoothly integrate into the grid and perform as expected.

The grid analyst workflow…

Each time a data center, a factory, or a wind farm wants to be connected to the grid, a thorough study is required. Utility analysts determine how new equipment will impact the performance of the existing power system. The analysis is done by assessing historical grid operations (how was the load if circuit breaker A was closed in area X?), as well as using simulators (software equipped with electrical engineering equations) to determine the future behavior of the network.

If there is limited room for growth an upgrade might be needed. You can potentially increase the number of taps on the transformer to provide for a larger voltage range. Overhead lines can sometimes be replaced with ones with a larger cross-sectional area (and thus a higher rating) or a new underground cable can be mounted. Perhaps it will be even required to install an additional circuit.

It’s important to properly forecast future growth and design of the market. Will the grid be able to handle the load given the projections of the sales of the electric vehicle for the next decade?

Is it better to invest time, money, and resources into a multimillion and multiyear project aiming at a new substation and circuit? Or it’s better to make a series of gradual but more incremental improvements spread over time? There is also a social aspect to it - although the law requires utilities to treat everyone equally, shouldn’t a school or hospital be given priority over a data center?

… is only getting more and more challenging

Historically, for the grid based on large nuclear, coal, or gas power plants, the analyst workflow was easier to manage. The development always took longer than the time you need to develop the transmission grid. This has changed. Permitting and development times for renewables are much faster than the development of transmission lines. We now have to make sure that the transmission assets are there when the renewables are starting to be developed.

Yet, there is an astonishing increase in the volume of interconnections requests being put to utilities and regulators.

Figures supplied by Berkeley Lab – a US Department of Energy Office of Science national laboratory managed by the University of California – showed that, at the end of 2021, more than 1,400GW of generation and storage capacity was in interconnection queues in the US. And more than 90% of this capacity is renewables, such as solar, wind, and battery storage.

The impact studies are more complex to make, the legislation often is lagging behind, and the pressure on analysts keeps surging. As a result, the typical duration from initiating the request to the operations doubled in the last few years. And quite some of the projects are not even getting built.

🧐 So what kind of innovation is happening in climate tech?

If we are to live up to the ambitions of energy transition something needs to be made. The climate tech industry realizes that conventional tools and techniques are reaching their limits and new, innovative solutions must be developed to accelerate the grid planning process.

The market is being disrupted from two sides.

First, the industry majors.

Siemens, ABB, Schneider Electric as well as more tailored players like DlgSilent dominate the market with their core simulator products - PSSE or Promod.

Simulators are power system modeling applications used in a wide range of scenarios including long-term planning, connection studies, operational planning, and real-time operations. They can be either Dynamic (based on RMS Root Mean Square Models), EMT (Electromagnetic transient ), or hybrid. The products often come in the form of offline desktop apps but there is a development effort to offer online simulation as well. That functionality, however, comes with a higher computational burden.

Very often these are the powerful desktop applications developed for decades. Practically, every analyst learns them as a part of the electrical engineering curriculum. Being incumbent gives an unfair advantage, yet, the companies are aware of the demands of current and future software applications.

The workflow of analyst requires functionalities such as:

❗️high performant time series database to quickly query large datasets

❗️data modeling following modern standards such as CIM and CGMES

❗️graph traversing

❗️integrations with data types such as geospatial, CAD, LIDAR, or event-based messages

❗️ability to securely share data within and across teams as well as with external parties

❗️smooth interface with Python and MLOps features

The gauntlet is being taken by climate tech startups and energy industry focuses SaaS companies.

Cognite, with its flagship DataOps software, helps Statnett, the Norwegian transmission system operator to liberate information from its source systems, including operational statuses, disconnections, generation capacities, and sensor data, and ingest it into Cognite Data Fusion®.

With all the relevant information needed to process grid connection applications accessible in one location, the grid operator can more efficiently add new power sources and consumers to the grid. Statnett estimates that improving how it processes applications is worth an estimated $1.2 million a year.

Pathfinder from Gilytics improves infrastructure design through spatial optimization science. GIS, Satellite, and spatial data in most formats can be easily uploaded into the tool and the algorithm generates different pathways and analytics to measure costs and environmental or other parameters set by the customer that can be exported into different formats for more accurate reporting. Thanks to Pathfinder’s workflow the entire planning can be done 5 times faster, saving up to 6 months in the project process, and leading to even a 30% cost reduction.

Neara, an Australian startup, developed a physics-enabled platform that builds 3D interactive models of critical infrastructure networks and assets. The software has the ability to run real-world scenarios, assess current and future risks, and prioritize maintenance and disaster response. Fitted with LiDAR and geospatial data, and informed by engineering specs, existing conditions, and other network-specific data, this digitally built environment leverages artificial intelligence (AI) and machine learning (ML) to intelligently unify data, and expose insights into utility operations.

Operations & Optimization

Electricity flows across the path of the least electrical resistance and that means that even a grid operator cannot control the exact path the electricity follows. Yet, since a transmission line can carry only a limited amount of power, the operator needs to make sure that too much power isn’t transferred over any single line.

Distributed energy resources (DERs) like electric vehicles, home batteries, rooftop solar panels, and PV plants are disrupting the century-old model of how the grid operates. It was based on a one-way delivery of power from central generators through transmission and distribution networks to end customers. Placing the DERs in the middle of that network is a paradigm shift for operators around the world. These new pieces of equipment can disrupt local grid voltages, and increase loads on circuits in hard-to-predict ways.

Traditional, SCADA tools often do not let you go beyond the control room and connect lower voltage equipment. Existing applications, built for power system analysis and impact studies like Etap or EasyPower miss modern SaaS functionalities, do not have any compatibility with data science tooling and stay in a silo in the operators' IT architecture..

🧐 So what kind of innovation is happening in climate tech?

Utilities have been investing in sensors and control solutions as well as software products to analyze, predict and handle these issues and to navigate the novel situation.

🎯 Advanced Metering Infrastructure

The first step is to bring an additional layer of visibility beyond SCADA. Utilities usually achieve that by the installation of the so-called AMI - Advanced Metering Infrastructure and intelligent electronic devices across the network. It consists of smart meters that provide visibility at the low voltage level, Phasor Measurement Units (PMU) -Real-time measurements (30 to 60 samples/second) of multiple remote points in the network or Remote terminal unit (RTU) - A microprocessor-controlled device that transmitting telemetry data.

Next to that utilities invest in data management systems, and communication networks to provide bidirectional communication between customers and utilities.

🎯 Dynamic Line Rating

One of the smartest ways to increase grid capacity without laying out expensive new transmission lines and infrastructure is the installation of a Dynamic Line Rating (DLR) system. DLR is a transmission line’s actual real-time or forecasted power-carrying capacity. It is based on the phenomenon that the wind cooling effect boosts the capacity of the power lines. DLR is typically 10 - 25% higher than its static rating. The technology can reduce costly grid congestion, improve contingency planning, defer or eliminate the need for line upgrades and even accelerate the interconnection of renewables.

Ampacimon’s Dynamic Rating (ADR) system developed by Belgian company Amapciomon the most trusted and widely used dynamic line rating (DLR) system in the world. The solution uses three seismic-grade accelerometers to measure low-frequency vibrations of the transmission line to determine line sag/clearance, perpendicular wind speed, and mean conductor temperature. With the addition of an optional embedded tension sensor, ADR Sense can also measure ice accretion weight and conductor health metrics such as creep, and remaining useful life.

🎯 DERMS & VPP

Distributed energy resources are connected to the grid “downstream” from the utility substation. This setup creates challenges such as changes to voltage profiles and frequency management concerns for local grid nodes. In order to avoid outages, utilities (namely DSOs) need to understand all grid activity, at each local node, in real time. Understand and have the ability to control and influence that.

Yet, currently existing SCADA systems don’t operate in the timeframes needed to avoid local grid imbalances and don’t provide necessary visibility for a growing amount of distribution-level devices.

One of the most promising solutions to address these issues is a microgrid controller. It allows the utility to manage and coordinate localized DERs, independently balancing real and reactive power and efficiently dispatching resources ensuring power quality. By having microgrid controllers at multiple substations, DSOs can reshape a load profile, provide frequency maintenance and keep grid nodes in balance. PXiSE - a microgrid controller solution developed by Yokogawa, had 1.5 GW of contracted assets in 2022.

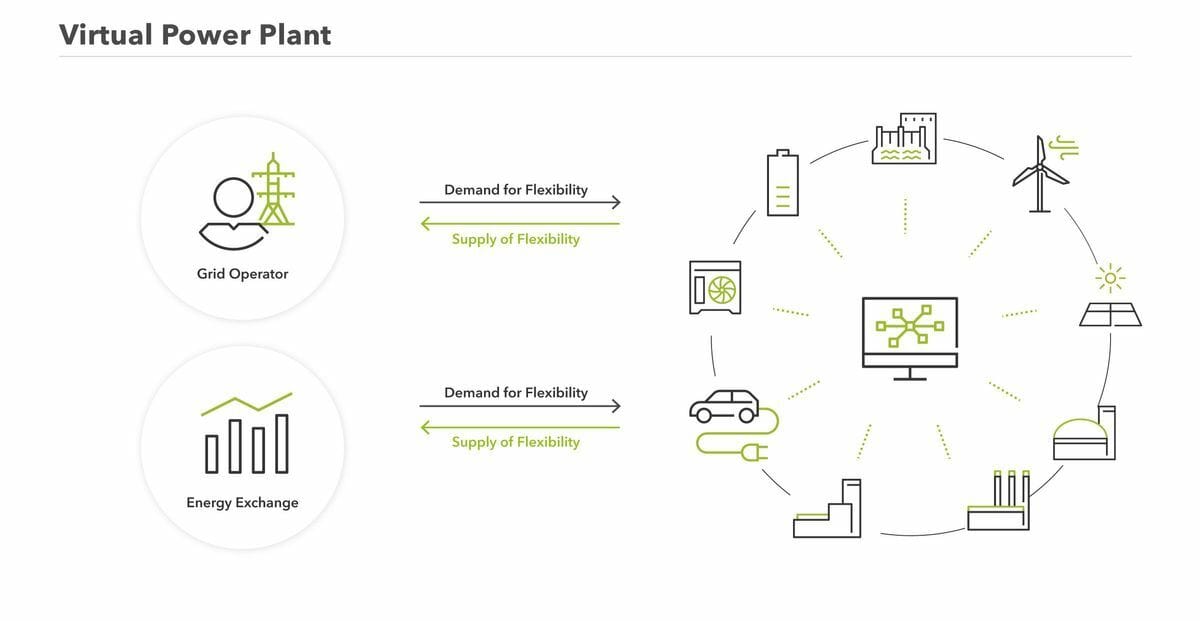

The ability to aggregate a control a large number of DERs converged into the concept of a Virtual Power Plant (VPP). In essence, it’s a virtual network of decentralized energy assets that can dynamically control the load, and produce and store energy based on real-time pricing signals.

A Distributed Energy Resource Management System (DERMS) is the way to operate a virtual power plant. You could say that DERMS is a control system specifically designed to handle DERs. It acts as a switchboard, combining DERs into grid-wide resources to simplify the control, monitoring, and management of those systems.

And that technology creates enormous economical opportunities. By curtailing energy consumption during peak demand periods (when prices are higher), you can reduce your overall electricity costs. But, if you have a battery, you can also capitalize on that situation by selling energy back into the grid.

The DERMS and VPP markets are still nascent, however, there is already a number of strong players out there.

AutoGrid, established at Stanford University in 2011, today has more than 6,000 megawatts of DERs under contract with Xcel Energy, National Grid, E.ON, CPS Energy, Total, and NextEra Energy. AutoGrid DERMS is one of the industry’s most comprehensive distributed energy resource management system (DERMS) applications, letting you manage all types of distributed energy resources from smart inverters, storage devices, and combined heat and power units (CHPs).

EnergyHub, another US player, features over 60 utility clients and 2,900+ MW of load under management, and a range of sophisticated DER management products. EnergyHub’s Mercury DERMS platform offers a number of features that specifically address the unique operational and ownership aspects of behind-the-meter grid-edge DERs: Customer-centric resource formation and aggregation, optimization (load shaping, voltage, and frequency management) as well as forecasting.

Next Kraftwerke, a German startup acquired in 2021 by Shell, is the operator of one of Europe's largest Virtual Power Plants (VPP), having more than 10GW of assets under management.

The performance of VPP is driven by the diversity, density, and resilience of the DERs connected to the network. In other words, by the flexibility, it can provide.

As of 2023, DERMS and VPPs are becoming “must-have” technologies and vital parts of the power grid lifecycle. The power grid of today needs to be based on digital technologies that enable utilities to communicate with DER and make operational decisions to provide safe, reliable, and cost-effective services to all customers. Moreover, these technologies will play a key part in enabling smart prosumer services and consequently providing additional revenue to utilities, grid participants, and consumers.

Maintenance

So we know how to accelerate the grid design process, integrate new DERs, and monitor and improve the performance of the existing assets but … we still need to maintain decades-old existing infrastructure with some components surpassing the century mark. And all of the new installations and variable load profiles are putting additional stress on the equipment. Stress was definitely not included in the design phase 50 years ago.

That’s already observed in more frequent and severe grid outages. In fact, utilities are not worried if the outage will occur but when and where. That means more investments and effort are being spent on monitoring and predictive maintenance solutions.

🎯 Smart Substation

The substation is the heart of the power system and the power transformer is by far the most expensive and the most critical component. It costs millions of dollars and can take month months to replace in case of failure. The transformer is very reliable equipment (units in good climates with low operating temperatures can last well lover 60-70 years) and therefore maintenance is often neglected.

Having models at various maturity stages, coming from different vendors, with different levels of instrumentation can add to the complexity. Transformer monitoring relies on temperature, electrical, mechanical, and chemical sensors.

Gas analysis, oil samples, and visual inspections are the most effective methods to detect the condition of power transformers. Therefore, most of the condition and predictive maintenance is based on analyzing these parameters (using for example the Duval triangle) and estimating the health score from that.

Transformers were designed for continuous operations but with more and more renewables and changing power flows and load patterns, power transformers are operating in a new regime. That opens up room for innovation.

Siemens and ABB, the supermajors of electrical equipment are leading the pack in providing both necessary hardware as well as industry-grade asset performance monitoring solutions. However, there are a few other players worth observing.

SeetaLabs is an Italian startup that created a RONIN AI Platform® for the real-time calculation and health monitoring of large power transformers to prevent abrupt power outages due to machine faults and to predict manufacturing power needs. Their AI algorithms were built using 10 000 assets and need 14 sensors to create a transformer health index. RONIN AI takes care of data processing, interpretation, MLOps, and security.

🎯 Power lines inspections

Each utility needs to monitor hundreds of thousands of miles of power lines spread across various types of terrain - valleys, hills, and mountains. Despite SCADA data and even DLR solutions, visual inspections are a critical part of regular maintenance plans. And since utilities want to reduce sending technicians, drone-based solutions are being exploited.

eSmart from Norway is one of the most prominent players in the field.

Additionally, traditional drone OEMs (like DJI) as well as drone-data software providers are expanding their capabilities to suit power line inspection workflow.

🎯 Vegetation management

Each year, thousands of wildfires burn through millions of acres of land around the world.

We’ve already seen the mass devastation that wildfires can bring, especially in places like Australia, or California. And with climate change, it likely won’t get any better.

Vegetation is one of the key factors making an area more vulnerable to wildfires - a region with drier vegetation may catch fire more easily.

Utilities are aware of the risks it brings to the electrical infrastructure so a more detailed understanding of asset conditions and threats from the surrounding environment is desired. Technologies such as LiDAR, satellite, and GIS enable operators to better manage assets and minimize the risks wildfires bring.

Pano AI (Pano) - Californian startup aspires to be a global leader in early wildfire detection and intelligence, providing government, utilities, insurers, and private landowners with advanced tools and up-to-the-minute intelligence to quickly mitigate wildfire threats while protecting lives, property, and the environment.

Pano combines advanced hardware, artificial intelligence, and software in a single integrated enterprise solution. Leveraging data and satellite feeds, as well as propriety imagery from a network of ultra-high-definition, 360-degree cameras atop high vantage points, Pano’s artificial intelligence model produces a real-time picture of threats in a geographic region and delivers immediate, actionable intelligence.

Timble, an established US software player, developed the so-called “Trimble Vegetation Manager” - a modular system for Utility Vegetation Management.

From work identification to prioritization and field execution - Trimble VM lets you optimize your vegetation response. It’s basically a full CMMS app for vegetation management.

⏭️ Summing it up

As the market for innovative energy solutions expands, the number of companies offering vertically specialized data connectivity services has increased. These companies connect data from nodes within specific industries, such as solar energy, electric vehicle charging, or home energy management, to support applications like demand management and planned usage.

However, many of these energy data connectivity startups are currently focused on building out more SaaS and services within their individual sub-sectors, rather than branching out across different verticals, in order to retain and increase their existing customers' average contract value. This verticalized approach demands customization, which can result in startups functioning like system integrators and charging high fees for large service contracts to meet their revenue goals. This focus on traditional linear growth disregards the potential of networks and the exponential growth they can generate, which has already been demonstrated in other industries.

ClimateTech solutions for the power grid need to be built with a network design in mind

While individual tools in each category can perform well as standalone solutions, it is important to consider the information architecture and communication when implementing them.

Utilities tend to be slow to adopt new technologies and can take a decade or more to progress from laboratory tests to pilot projects and limited deployments before they are widely adopted. Additionally, they often rely on a small group of established and trusted vendors for major purchases and installations. There is no space for hundreds of PoCs with cleantech startups.

But at the same time, utilities are fully aware of the challenges posed by intermittent energy sources. There are significant investment programs in place, but the question remains, how should the funds be allocated to ensure grid stability? What is the most effective way to use each dollar to maintain grid resilience in light of NetZero pledges?