- ClimateHub

- Posts

- Future of Asset Performance Management (2023)

Future of Asset Performance Management (2023)

How new technologies will shape wind farms O&M

TL;DR

The wind industry is one of the major drivers in energy transition and a force behind the world's electrification

Traditionally, maintenance of the wind turbines has been the domain of big Western OEMs but the dynamic is changing

Wind farm operators have increasing willingness, knowledge and experience to run the machines themselves.

The climate tech market is helping that move as well. Big Data and digital technologies created a wave of innovative companies that revolutionize the way wind turbines are being maintained

Initial, SaaS players offering basic dashboarding and KPI monitoring are being disrupted by digital twin providers, drones, new types of instrumentation, and wider industrial DataOps offerings

Wind is one of the core energy transition technologies of tomorrow. It’s a strong pillar in the climate tech space as well as an area of intense innovation as project developers move into deep offshore waters. The industry is maturing and already today is a fundamental technology in the global energy mix. Needless to say that over the past decade, in certain regions of the world, the cost of wind farms went below thermal power plants and is poised to go down even more.

The growth is and was tumultuous. Although the old-known fears of environmental damage (birds), and noise (NIMBY) are being handled by project developers, technology itself, and legislation, there are new clouds on the horizon. The rising cost of materials, delays in granting permits for new plants, and financial troubles among Western OEMs.

Yes, the wind fleet is and will be increasing. According to Wind Europe globally installed capacity is going to increase from just over 50 GW (in 2021) to more than 300 GW in 2030. And that’s just offshore wind.

We are past a certain point. Nobody will stop the tsunami of renewable energy projects.

This is brilliant. Yet, at the same time, that also means more pressure on operators of wind power plants. They are expected to squeeze more energy and dollars from the assets with fewer people and tighter budgets. All in the environment of increased competition (especially in South East Asia), merchant risk due to a decrease in governmental support, and global supply chain issues.

🌏 The evolution of Asset Performance Management

To succeed as an operator, you need tools that provide you with the best insights on your wind farm performance, empower your O&M teams to collaborate and automate critical workflows, and enable you to take the best decisions. Best for the company, your team, and the machinery itself.

Asset performance management (APM) is a collection of software tools and services used to collect and process data to boost the performance of industrial assets. APM supports workflows such as equipment health monitoring, failure mode analytics, reliability analysis, maintenance optimization, and integrity management. They are designed to monitor a set of Operations & Maintenance (O&M) KPIs such as Intervention Time, Resolution Time, Mean Time Between Failures (MTBF), and a few others.

Until recently, most of the APM work was happening via manual processes and spreadsheets. Although it’s still the case for some operators, the majority already realized these methods are obsolete. The pursuit of operational efficiency, the growth of the portfolio, the complexity of market regulations, and risks are the most predominant challenges

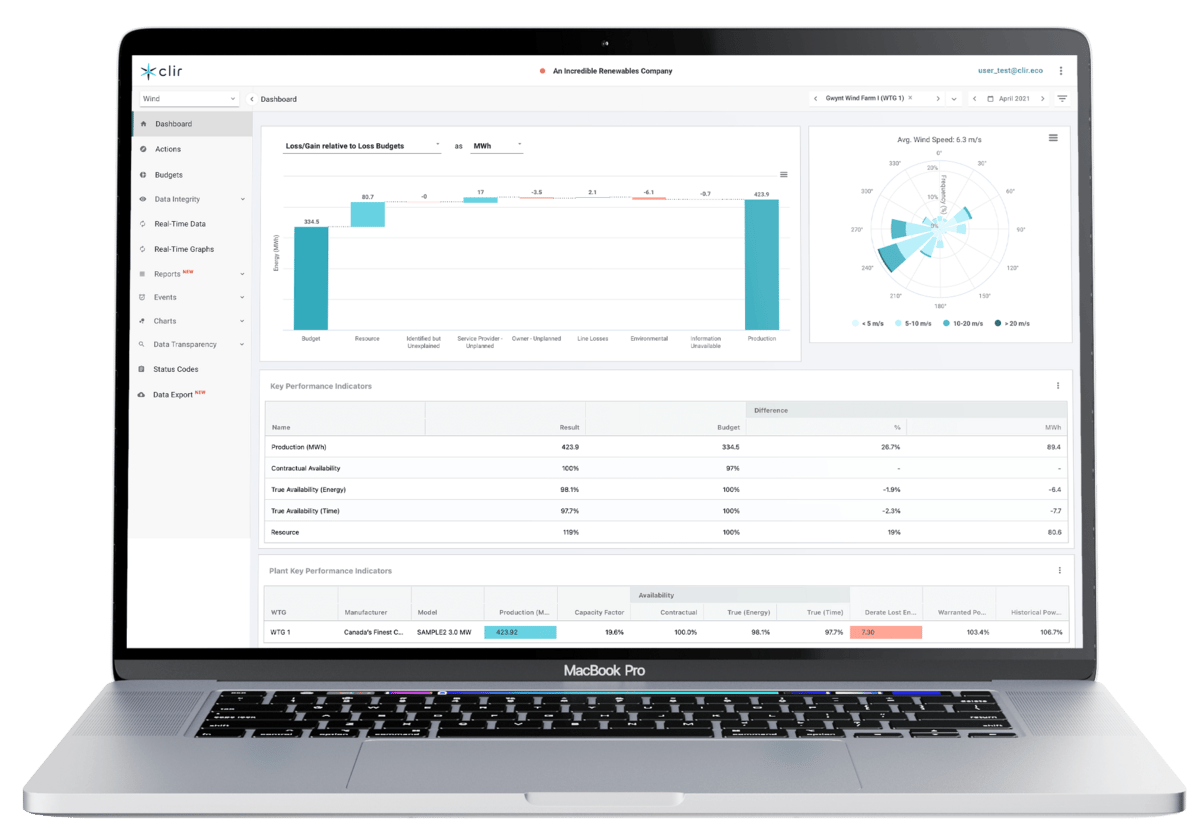

Challenges that many turned into opportunities. Greenbyte, recently acquired by PowerFactors, was offering a set of customized wind farm management dashboards. Clir provides operational insights based on data coming from 200 GW of wind and solar plants. IBM heavily promotes its Maximo APM solution.

The snag is, all of these tools, provide basic dashboarding and work order management solutions. Some offer an efficient integration with field engineering personnel and contract management. Some, capitalize on the big data wave and include analytics.

These tools triumphed in the APM 1.0 world. A world where getting ahold of data was the first priority.

World when you had a relatively small fleet and most of the contracts were under 20 years of service agreements. Basic KPI monitoring, reporting to stakeholders, and work order management functionalities were enough.

Yet, as the wind sector kept growing, which meant means larger, more complex portfolios for most operators, the need for more sophisticated tools emerged. Moreover, with the advent of Big Data and AI, many energy companies invested in in-house data analysis teams.

Tipping point

Ultimately, wind farm operators noticed the infliction point. The multi-brand (Vestas, Siemens, GE) and multi-technology (hybrid plants) portfolio contrasted with the wish to shovel O&M margins and do services in-house.

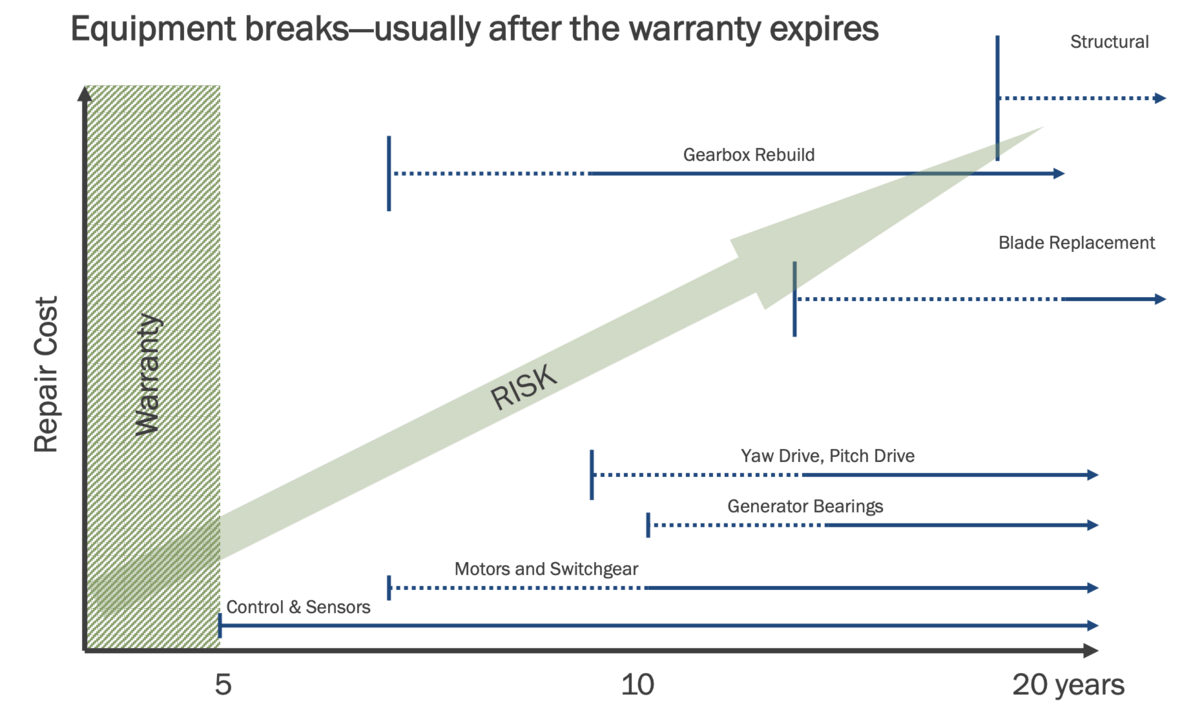

That became especially relevant closer to the End of the Warranty period, which comes typically at 2-5 years into a project’s life is critical. This is the point when operators have to take critical decisions around post-warranty service agreements and operating strategies.

This situation opens a world of business and engineering opportunities and is shaking the APM philosophy.

The proliferation of data analytics solutions

The first to spot the opportunity were the data analytics and platform solutions providers. In the past several years, the wave of SaaS swept through the industry. A few stopped at the PoC (Proof of Concept) level, while others gained some level of adoption.

But they made a dent in the perception of APM among the industry veterans.

Enabling API and access to data became a must-have that operators across the world demand and treat as a default feature. Vendor lock-in is a red flag for anybody willing to achieve success in the APM space. The multi-technology portfolio requires standard communication protocols, REST API, and compatibility with modern software and data science technologies.

That caused the emergence of players such as Uptake or SEEQ.

Furthermore, as data visualization became the norm, wind operators acknowledge the power of simple visualization solutions such as Microsoft PowerBI or Grafana.

👶 New kids in town

Yet, as time passed, experienced operators quickly noticed that typical SCADA data with machine learning models and visualization can only give you as much. Once the low-hanging fruits (e.g. developing basic gearbox oil monitoring or yaw misalignment) were taken, the pursuit to handle more complex failure mode began.

But you needed more data for this.

That led to opening the wind industry ecosystem to new players.

First, the sensors.

As the wind turbine design progressed, a new set of monitoring solutions were installed. Still, that leaves us with a large fleet of turbines commissioned in the last two decades that lacks more sophisticated instrumentation.

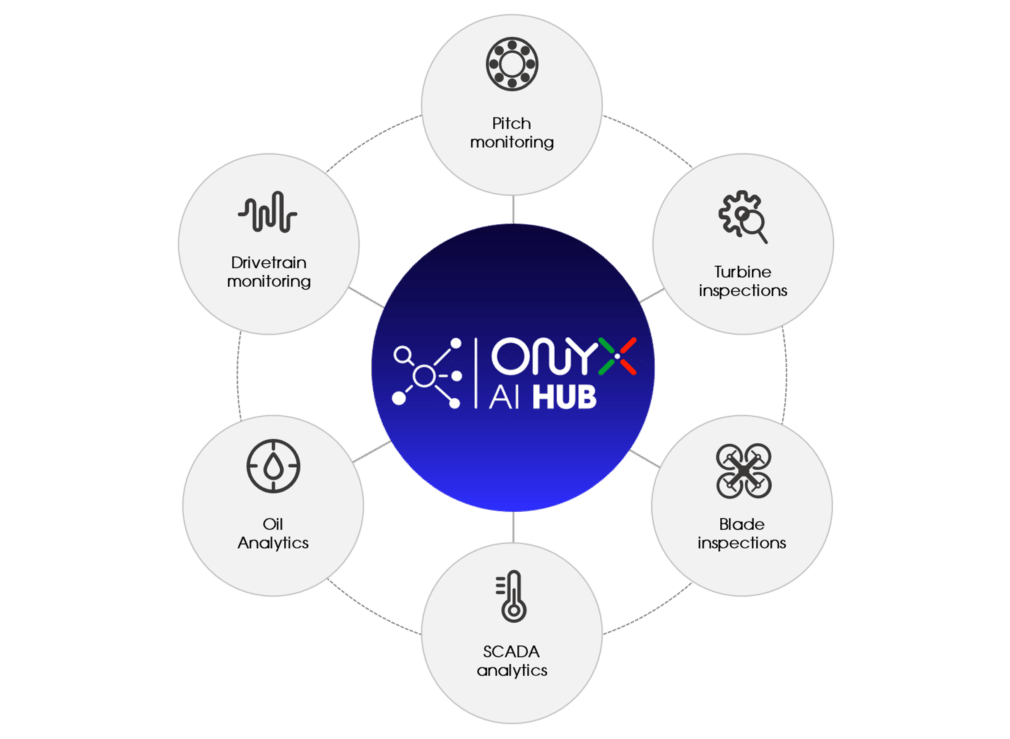

Onyx Insight (founded in 2017) and Sereema (founded in 2015) jumped on the opportunity and developed dedicated sensors that can improve existing SCADA and condition monitoring systems. Over time, they further expanded into software and today offer a compelling value proposition to operators willing to increase annual yield from their turbines.

Second, drones and robotics.

The hardware revolution consequently moved from simple sensing devices to drones being able to perform a specific mission. The Chinese OEM - DJI saw wind as yet another industry to conquer. Flyablity, a Swiss “drone in a cage” manufacturer spotted potential in the difficult interior blade inspection. Skyspecs, which started as software to manage drone missions is actually expanding and developing more holistic APM features.

Third, 3D digital twin and immersive technologies.

Despite sophisticated instrumentation and more and more powerful drones, a few fundamental problems were there. How do empower collaboration across the teams with the heavy, desktop-based CAD software? How do I reconstruct the farm data if all I have is the basic CAD model or assembly drawing in pdf? Can I have a flavor of Google Maps experience in my own fleet?

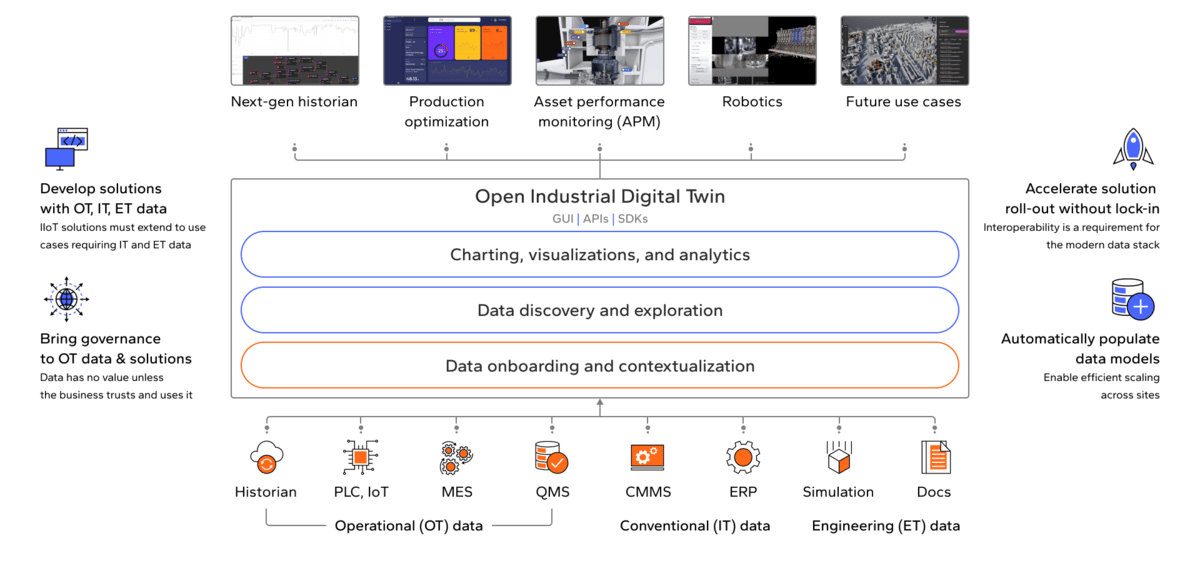

Although the topic gained a lot of buzz in the media, the only solution able to actually provide all required capabilities - full 2D and 3D data contextualization, leveraging point cloud, photogrammetry, engineering drawings as well as wider IT/OT/ET systems is Cognite Data Fusion.

🧭 Where is it moving?

This all creates a situation where APM 2.0 is being shaped. At ClimateHub, we believe the following trends will further accelerate and become critical in 2023 and beyond.

Ability to do more yourself

There is an industry-wide consensus that in-house competence is critical. Especially, while dealing with emerging technologies in a more fierce market. That also means more expectations toward APM vendors. Just querying data from the ODBC interface or exposing REST API won’t be sufficient to stand out from the crows.

The APM 2.0 need to support holistic workflows combing the cross-team processes such as equipment condition monitoring, root cause analysis (RCA), maintenance planning, and execution.

It’s less about “which features do you have” and more about “how can your tool accelerate my existing workflows”. Operators will be asking “how drones and robots can empower your APM solution” and be less impressed with yet another dashboarding tool.

Nobody can operate your assets better than you - said every wind farm operator in 2022

When it comes to AI and analytics, maintenance engineers are more willing to trust and use algorithms if they’re allowed to tweak the output a little bit.

Furthermore, we still need a bridge between current market demand and growth targets and a shortage of talent. In these circumstances, we will need both digital solutions supporting knowledge exchange and efficiency as well as vendors providing service and support agreements.

Youtubization of APM

An interesting thing we can learn from the younger generations is how they consume information. Today, Youtube and TikTok are major sources of news for generation Z. They are passed Google Search and handbooks in PDF format. Who has time to read the manual if you can have a digestible 10-second long “How to” video?

Digitalization empowers the workforce - Satya Nadella, CEO of Microsoft

The COVID-19 pandemic accelerated that trend even more. It forced firms to adopt digital collaboration tools to operate remotely and invest in remote working technologies. And once we discovered how much (or sometimes how little) can be achieved by tools like Zoom or Miro, there is no way back.

Technology becomes better and will allow us to do even more. High-fidelity 3D data acquisition is becoming faster, more reliable, and more affordable. The consumer world is awaiting the Metaverse and looks up to 2023 when Apple supposedly will release its augmented reality glasses.

The building blocks of more sophisticated and immersive APM are already there. Executives are aware that companies won’t stay competitive if they don’t adopt the technologies of the future.

Optimization, optimization, optimization

Gartner considers “financially optimized maintenance” as the biggest ROI use case in the APM domain.

With more and more data under the good, more risky merchant markets, the need to align internal stakeholders, and optimization are becoming the king. At ClimateHub we believe it deserves even the same attention as AI.

It helps operators with decisions such as:

when shall I perform maintenance considering production loss related to variable wind power, variable energy price on the market, logistics, and crew availability?

what’s the cost level of operating at low performance

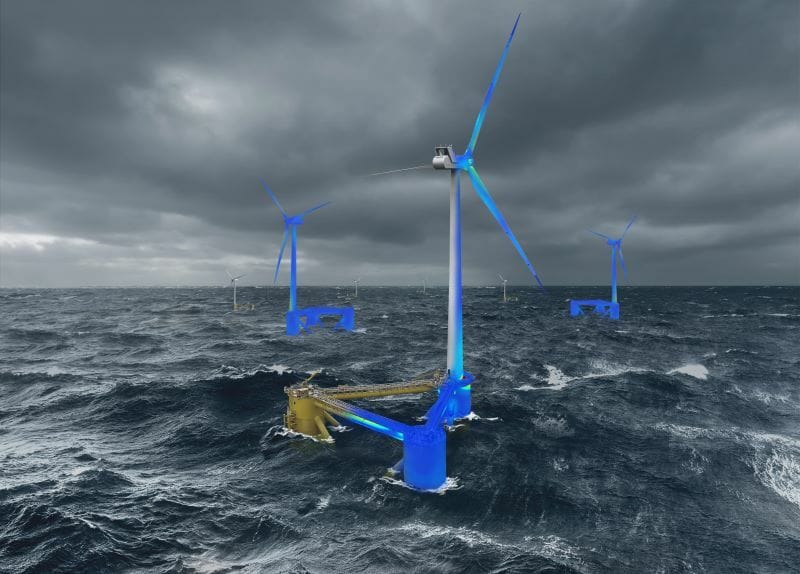

which O&M strategy I should apply for my new floating wind project?

Currently, operators try to handle these topics in-house, spending tons of money and energy on internal tools and projects. It’s perfectly ok as long as you built a solid DataOps foundation and do not re-invent the wheel and get stuck with data warehousing solutions and point-to-point integrations.

⏭️ Further opportunities

Although the move is definitely driving the APM sphere and accelerating cost reduction, increased safety, and higher yield, there are 3 areas that are expected to gain momentum and unlock new opportunities.

⭐️ Data modeling and sharing - despite ongoing data access and sharing disputes, in order to support scale, the wind industry needs alignment around data standards, naming conventions, and ontologies. One should also look inside. Eliminating cross-functional bottlenecks is mainly about ensuring that the people with relevant information are allowed to share it.

⭐️ Improved design - given the singularity of the business (key components of the wind farm are often provided by one major supplier - turbine OEM), it’s surprising how little has been done in terms of combining FEM (Finite Element Method) lifecycle and strength analysis with the real-life operation. Enabling that together with control system integration is fundamental for creating an independent and autonomous digital asset.

⭐️ Connecting the entire wind farm lifecycle - while every energy company is in pursuit of growing its renewable portfolio, the market leaders will be the ones that would master synergies across development, construction, commissioning, operations, and trading. Optimal site selection, accurate financial modeling, mistake-free project execution, and EPC are fundaments to successful O&M and market operations.

🎯 Summing it up

APM was always placed in between computerized maintenance management systems (CMMS) or enterprise asset management (EAM) applications and wider industrial software and control systems.

The proliferation of Big Data and digital technologies shifted that perspective.

And while APM 1.0 was the first attempt on moving from SCADA views and HMI locking by providing basic data visualization. APM 2.0 is about improving the entire workflow between the control room, maintenance teams, planners and field engineers, and new personas interested in APM - traders, risk managers, and business developers. All thanks to the latest software and hardware developments.

The future is already here.